Showcasing the transition to tech: Matt Nacier

Running toward opportunities in tech and crypto

Edited for brevity and clarity

Hi Matt, thanks for speaking with us today. Can you walk us through your career to kick us off?

While I was at Boston College, I did an internship in Private Equity. I was completely green; just getting around financials and modeling, but I worked hard through the summer and eventually earned a full-time offer. I returned to the firm - Lincolnshire Management - after graduating from BC.

What happened next?

In total, I've spent nearly five years at Lincolnshire. I spent some time away from the firm and in that time, I volunteered at an accelerator helping underrepresented founders. They might have expertise in a specific field or industry, and I tried to bring my skillset in financial analysis, planning and organization to strengthen their infrastructure and organization.

You had a stint in crypto. How did that come about?

Frankly, the opportunity came to me! Like I mentioned, I had made an effort to be involved and adjacent to startups. I was helping people at the beginning stages of creating their companies, and another volunteer and I got along well, and while we were working together, they asked me to join.

Why leave private equity to move into crypto?

Most importantly, I thought I could help with the firm's goal and mission. Iconic Funds is trying to drive the broader adoption of crypto by investing in companies and creating financial products. At the time, they were one of the few places full of former finance professionals. Moreover, I was and remain structurally bull-ish on crypto. I wanted to help and had a sense of what was already possible.

Were you ever worried that if you left private equity you would not be able to come back?

No, I don't think so. If you're good at what you do, and you maintain strong relationships through exit, there is always a way back. If you're familiar with the firm and fit into culture it can make sense to hire someone you know. In my case, a perfect storm of personal things put me in a situation where I had to go back to PE. I still love Iconic Holdings and crypto and maybe someday I can help the two asset classes overlap.

When you moved into crypto, how did you learn new skills and concepts?

First, I tried to exhaust the resources that existed. I read papers and blogs online, I listened to podcasts and then spoke with people in my network. It was really important for me to find people that I could ask questions to, and then over time, I was able to ask "better" dumb questions. If I think about it, it's not that different from conducting due diligence. As you build more knowledge in a particular space, you can ask different questions and comprehend more in-depth answers.

Anything else?

With crypto in particular, you can learn by doing. Trade some cryptocurrency, try to program on blockchain and go through a transaction process. Doing each of those things will teach you about the ecosystem as a whole.

Any advice for people who are starting this process?

It's important to run towards a goal or an idea, as opposed to running away from something else. The first 10 years in finance, and maybe even more, are not particularly pleasant. If you can't compete, or just don't want to, you should figure that out as soon as possible and then align your career with what you're more interested in. Think about your skillset and what you do well, whether it's presenting, deep modeling, sourcing deals, or operational thinking. Whatever it is, figure it out and try to put yourself in a position to do more of it.

Give us your recent best: meal, book and watch.

Best recent meal is HiFi Ramen in Chicago. Best recent books include the Anthony Bourdain audiobook of Kitchen Confidential, Deep Work by Cal Newport, Metaverse by Matthew Ball, and Mere Christianity by CS Lewis. Best things I've recently watched are The Boys on Amazon Prime, Barry on HBO Max and the movie Nine Days.

More from moneymoves

The Associate Director of CX at Dr. Squatch, shares insights into the benefits of working at startups and essentials tips for landing a job and thriving in the startup environment.

3 months ago

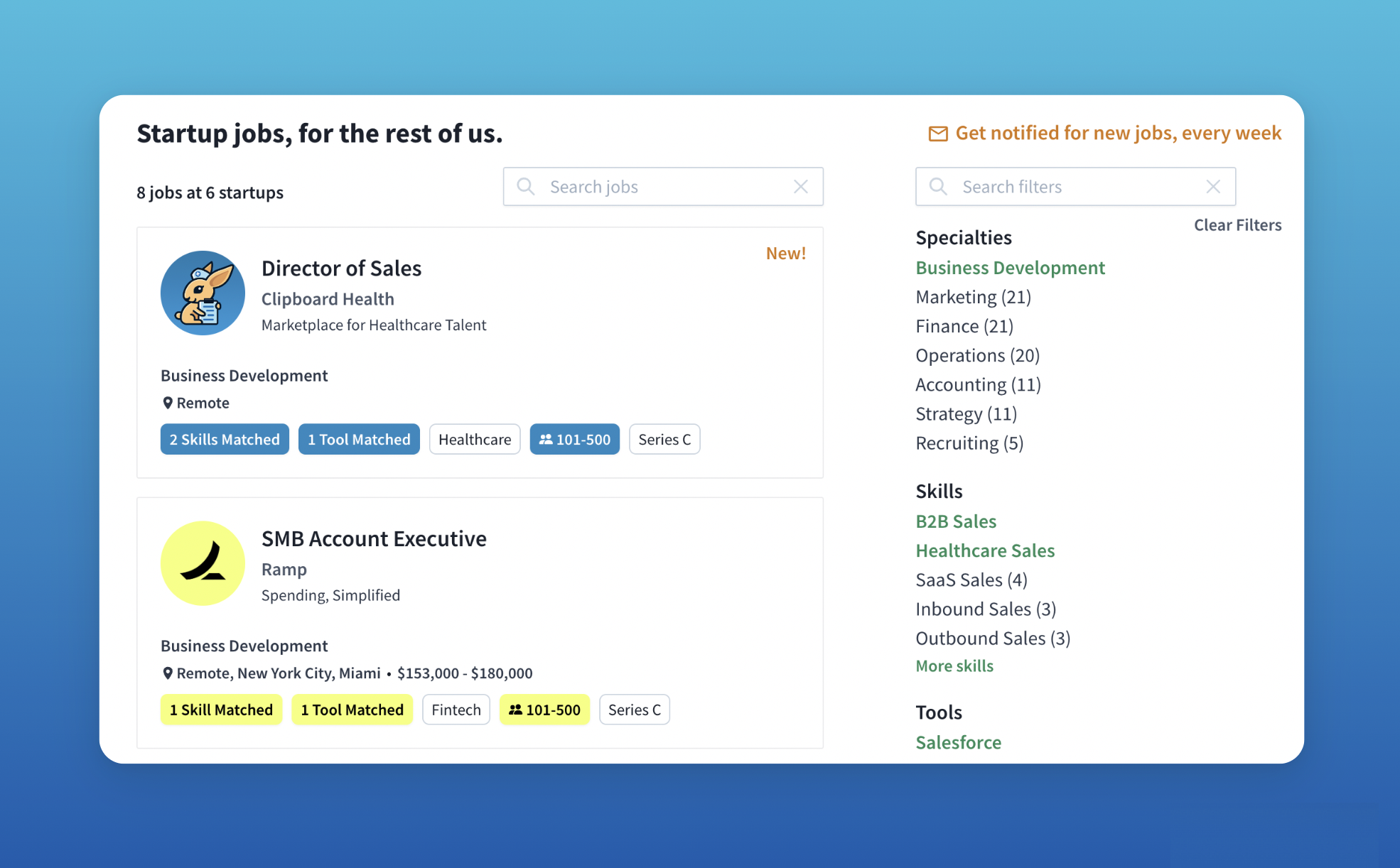

Learn more about the latest WFH-friendly opportunities from exciting startups hiring today on moneymoves.

2 months ago